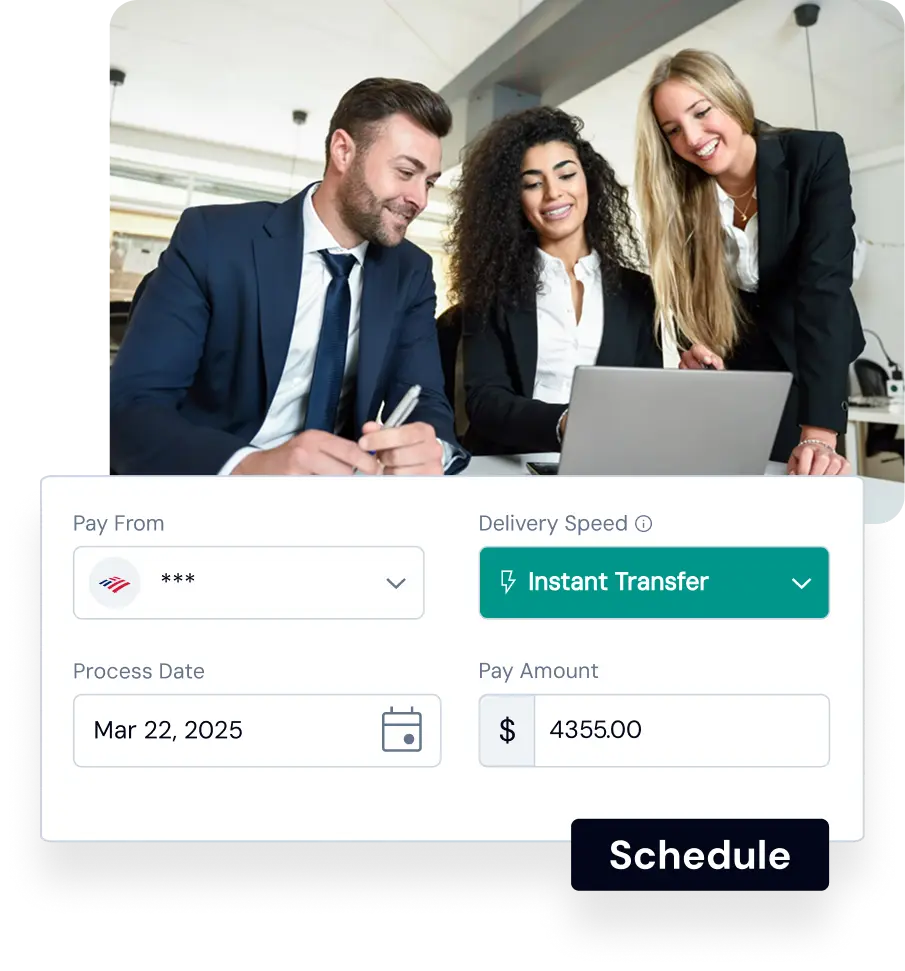

Stay in control of vendor bills, invoice payments, and cash flow

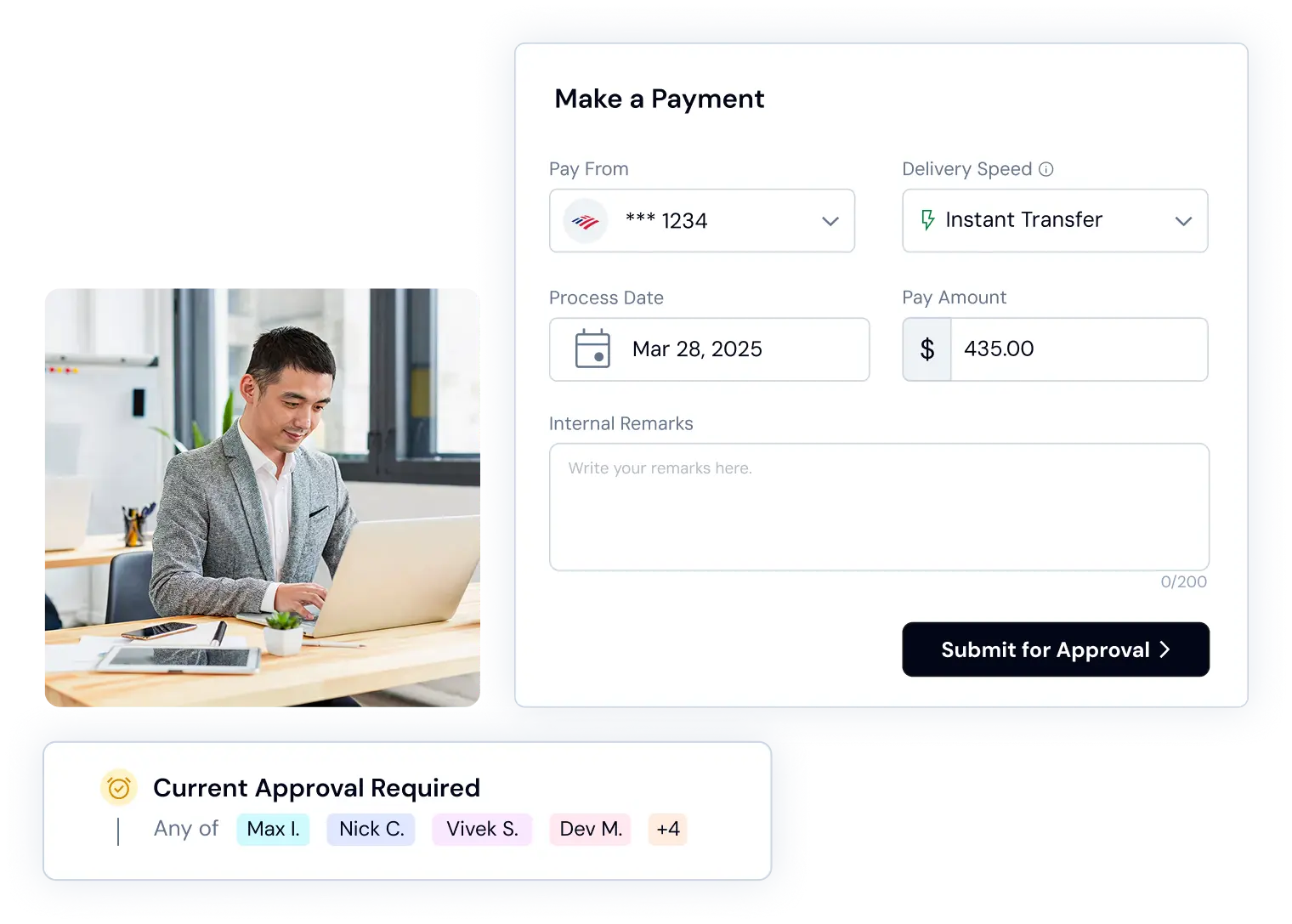

Stop wasting hours on manual accounts payable and accounts receivable processes. Forwardly’s intelligent automation captures invoices, schedules payments, tracks cash flow in real time, and manages approval workflows. From paying vendors to getting paid by clients, every workflow is faster, simpler, and more accurate.

Scale payments without adding headcount

- Save 70+ hours every month by automating manual AP/AR tasks

- Eliminate manual efforts, errors and missed payments with smart workflows

- Maintain full control with approval workflows and roles

- Stress-free 4-way syncing with leading accounting and ERP solutions

- No monthly fees, pre-funding, or credential sharing

- Simplify vendor payments, approvals, and cash flow visibility

Seamless integration with

Award-winning innovation.

Accountant-approved.

Get started

-

Don’t have an account yet?

Sign up now -

Looking for support?

Visit support center -

Pricing for businesses

Learn more

Frequently Asked Questions

Forwardly makes managing business's finances easier by connecting directly with the existing accounting software. It automatically syncs invoices and bills. With faster payment options like instant payments and same-day ACH transfers, businesses can keep their cash flow running smoothly. Forwardly also offers a 12-month rolling cash flow forecast providing a clear view of financial future.

Forwardly enables access to funds instantly, giving clients in the United States more control over critical cash flow as payments are deposited in seconds, 24/7/365. Learn more about real-time payments at Forwardly.com.

Forwardly enables accountants to help their clients get paid up to three days faster and easily identify cash flow gaps. Forget manual tasks and spreadsheets—our seamless 4-way sync with QuickBooks Online, Xero, FreshBooks, and Zoho Books eliminates manual reconciliation, data entry, and simplifies cash flow forecasting. Spend more time supporting your clients and less time on tedious tasks.

For accountants interested in earning referral rewards, visit Forwardly.com/Partners

With seamless 4-way sync, Forwardly integrates with existing accounting software, allowing effortless management of financial data without compromising accuracy. Never worry about late fees or missing payments again—Forwardly enables free instant payments and transfers directly from bank to bank, 24/7/365. Enjoy greater flexibility with partial payments, credit card payments, and the ability to schedule payments up to 90 days in advance, enhancing financial control for timely transactions.

Forwardly securely connects with leading accounting apps, including QuickBooks Online, Xero, FreshBooks, and Zoho Books