It may be the New Year in next couple of days – but there are plenty of things that stay the same no matter the date on the calendar. Foremost among those? The importance of cash flow management. Keeping tabs on your business’s cash flow and taking steps to be cash flow positive.

If you resolve to do one thing this year for your business, we recommend you start implementing cash flow management strategies. Join us in this blog as we reveal these effective strategies to keep your business financially robust.

Remember why cash flow is so important

A friendly reminder: 60% of small business owners cite cash flow issues among the reasons why their companies have failed. That’s many. But, at the same time, more than 80% who perform monthly cash flow forecasts survive. Coincidence? We certainly don’t think so.

If you’re not thinking at all about cash flow management strategies, then you’re unnecessarily putting your business in danger of going under. Especially because it’s not difficult to keep track of your cash flow.

Remember that cash flow is a matter of cash in and cash out, and knowing that margin between them. It’s all a matter of keeping expenditures and incomes monitored, and understanding the cash flow strategies to augment them both so you can get that margin exactly where you want it.

5 smart cash flow management strategies

Change how your customers pay you

Understanding how your customers pay is key for healthy cash flow. Check when invoices come, if they’re on time, or if you’re often chasing payments. Especially if you use trade credit, the time between delivering your goods and getting paid is crucial. If your monthly income swings a lot, that’s risky.

Here’s a cash flow tip: consider your credit terms. If it’s Net 60 or Net 90, think about making it shorter. Encourage early payments when in need by giving discounts, like 2% off if paid in 10 days. Losing a bit of the invoice cost can be okay in the short term if it means getting cash faster when it’s urgent. If changing terms isn’t possible, think about asking for a percentage upfront. It helps keep your cash flow steady.

Make things easier – use instant payments to dodge late payments. Pick platforms that make transactions happen faster, so you get your business payments on time without waiting around. This keeps your cash flowing smoothly and makes your business finances situation stronger. With Forwardly, you get instant payments at an affordable cost, and it takes less than 22 seconds to finish a transaction. Also, think about setting up automatic payments for extra convenience. This double move not only speeds up the payments you get but also sets up a super easy and reliable system for your business.

Evaluate your own payment terms

Let’s flip that idea now. Are your own payment terms fair and suiting your business?

If you have vendors that you consistently patronize and pay on time, consider renegotiating your net terms. If you’re currently paying someone Net 30, ask for Net 45 or Net 60, for instance. Or, if you’re currently paying on delivery, ask if you can deliver a portion of your payment on Net 30 instead. This will help alleviate your outflows, and allow you a window in which to pay that is best for your own cash flow – like paying after payroll has been processed, or your small business loan payment has gone through for the month.

Don’t forget that you’re only going to be able to negotiate more favorable invoice payment terms if you’ve been good about getting your payments in on time – so, if that’s not the case, make it a priority in the New Year, understanding there are long-term benefits from being a good client yourself.

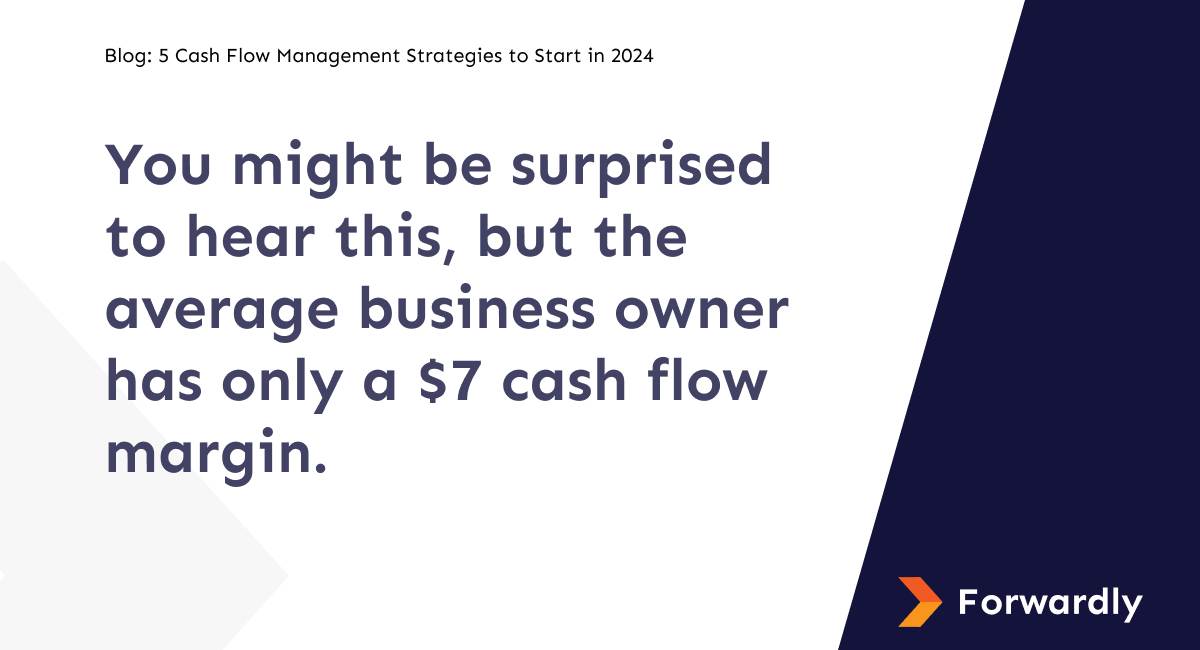

Know your cash flow margin

For every dollar you take in, how much goes out? Calculating your cash flow margin can help you figure out how much wiggle room you have, and the kind of cash flow management strategies you’d be best to implement. The simplest way to calculate your cash flow margin is to take your operating cash flow (which you can find on your cash flow statement) and divide it by your sales (which is on your income statement).

You might be surprised to hear this, but the average business owner has only a $7 cash flow margin. That’s not a lot of difference. If there are months in which payments don’t come in or your sales are lower than expected, you can quickly come into emergency territory. Calculating your cash flow margin regularly can help you see patterns as well as focus your operating activities in on something like lowering expenses, ramping sales, or collecting on invoices faster.

Learn to anticipate

No, you’re not a psychic – and we’re not telling you to become one. Business means lots of unforeseen issues, many of which you have to deal with as they come.

However, that’s not always the case. History has a tendency to repeat. For instance, if you keep coming up short for bills, or your raw materials cost fluctuates, there’s a chance that many of these problems are cyclical, or have specific causes. Maybe your material and labor costs are higher in a certain season or tied directly to trade policy. Maybe there’s a certain customer who doesn’t pay on time regularly.

The best thing you can do from a cash management strategy standpoint is to analyze your business performance trends and anticipate when you’re going to have your highest and lowest amounts of cash flow. Being proactive instead of reactive will serve you extremely well in the long run.

This also means regularly talking to people who oversee different parts of your operation, including your bookkeeper/accountant, sales manager, and more – only through understanding each part of your business intimately can you anticipate problems before they hit. It takes a village!

Perform monthly cash flow forecasts

If you’re not performing monthly cash flow forecasts, you should be. In fact, if there’s only one cash flow management strategy that you put into place immediately, it should be this one.

How else are you going to understand your cash position, see trends, and understand the changes you need to make? Remember that your cash flow forecast is different from your statement of cash flows. But you need both to be able to see your current and historical information.

A monthly cash flow statement will help you see how your accounts receivable and accounts payable are impacting your business’s cash flow, plus get a picture of how your debts, like business credit cards and business loans, affect your surpluses and deficits. Forwardly simplifies cash flow management, so you can do it all from one place. With Forwardly, you can easily assess your financial outlook, complete with rolling cash flow forecasts for up to 12 months in the future. This feature empowers you to plan ahead, making informed decisions for a more secure and stable financial future for your business.

Get started with Forwardly

Get ahead with your business finances today! Start using Forwardly for instant payments and powerful cash flow forecasting tools. With Forwardly, you receive Instant payments at just 1% (Minimum $1, maximum $10 per transaction), and same-day ACH is absolutely free. Forget the hassle of wallets or bank accounts – Forwardly makes it seamless. Integration with QuickBooks Online and Xero ensures secure automatic payment reconciliation, saving time for more meaningful pursuits.

It’s time to take charge of your cash flow. Amplify your business’s finances and bring certainty to your business’s future. Sign up now for free.

Back to Blog

Back to Blog